Advantages and Disadvantages of Fdi to Home Country

It is a scheme used when any person or any business holds at least a 10 share of any foreign company. This will lead to large capital outflows.

Advantages And Disadvantages Of Foreign Direct Investment Fdi India

Advantages and disadvantages of FDI to home country.

. Developing countries get much needed capital through FDI to achieve higher rate of growth in national income. Entry of large giants may lead to the displacement of local businesses. As a result balance of payment of host countries improves.

Loss of taxes and revenues. FDI provides inflow of foreign exchange resources into a country. Explore the definition the advantages of foreign direct investment and the.

To study the FDI trends and how it influences to India 3. Further FDI helps to increase the exports of the developing countries. FDI takes on two main forms.

The benefit of FDI to the host country is that the resources can be transfers which can give a good effect. Advantages And Disadvantages Of Foreign Institutional Advantages and Disadvantages of Foreign Direct Investment FDI for Germany. Foreign Direct Investment FDI is an investment by an organization from one country to another with the aim of establishing lasting interest.

Without Foreign Direct Investment economic success and global financial prosperity cannot occur. Disadvantages 2 When an American tech company opens a data center in India it makes an FDI. FDI is the acronym Foreign Direct Investment.

Several advantages can be claimed for foreign direct investment FDI. The Effect of Outward Foreign Direct Investment on Home. Repatriation of profits if the firms do not reinvest profits back into the host country.

While FDI or Foreign Direct Investment can be defined as an investment made in a foreign country for business or production purposes FII or Foreign Institutor Investor on the other hand is an investment made in the financial market of a country. Help in Addressing BOP Crisis. FDI Foreign Direct Investment simply refers to the act of investing capital in a business enterprise that operates overseas and in a foreign country.

Several developing countries mandate and require FDI for seeking economic growth. The first is a green-field investment which involves the establishment of a wholly new operation in a foreign country. There are advantages and disadvantages of FDI and FII both we will discuss them later.

FDI takes on two main forms. The following are some of the disadvantageous effects that foreign direct investment may have on the host countries. The enterprise that receives the investment will definitely benefit from this.

The party making the investment could be an individual a business corporation or maybe even a group of companies. Foreign direct investment has been a controversial issue in international economics. Despite many advantages foreign direct investment has some disadvantages that are outlined below.

Achieving Higher Growth in National Income. External borrowings need payment of interest regularly. This helps the country to solve adverse balance of payment position.

Explore the definition the advantages of foreign direct investment and the. The host country can receive the resources given by the home country thus it can improve the efficiency of operation and economic development. Costs of FDI for Home Country - The home countrys balance of payments can suffer.

The bottom line is that FDI occurs when a company has 2 facilities of operation in a host country where there is knowledge and technological transfer of resources. Objective The main purpose or objective doing this report is 1. The definition of FDI is not limited to glo View the full answer.

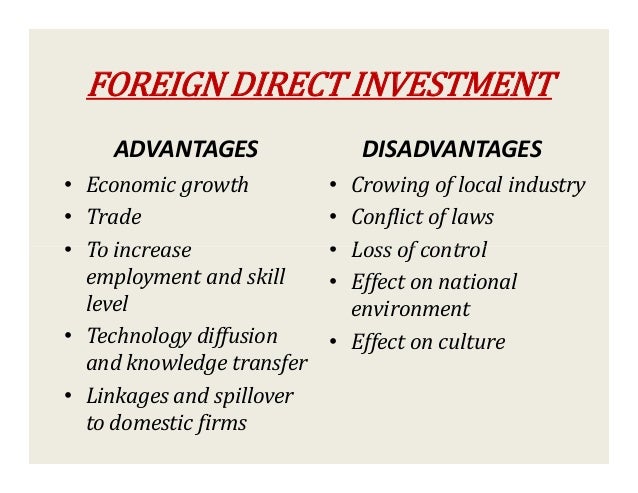

1 Such investment does not burden the tax payer since no interest at fixed rate is to be paid as in the case of foreign borrowing. Advantages and disadvantages Foreign Direct Investment Advantages and Disadvantages of Fdi Advantages of FDI. FDI Advantages and Disadvantages.

Disadvantages of foreign direct investment. From the initial capital outflow required to finance the FDI If the purpose of the FDI is to serve the home market from a low cost labor location If the FDI is a substitute for direct exports andor a substitute for domestic production This paper will. Developed countries Foreign direct investment has generally been found to have positive effects for firms in their home country.

Disadvantages of Foreign Direct Investment 1. External borrowings create a fixed liability and are repayable after sometime. The first is a green-field investment which involves the establishment of a wholly new operation in a foreign country.

The resources can be said that such as capital technological and managerial skills. Most host countries especially the developing ones tend to implement policies. The Foreign Direct Investment means cross border invest- ment made by a resident in one economy in an enterprise in.

Foreign Direct Investment FDI is better than the external borrowings. In simple words FDI is the investment made by any individual or firm in countries apart from the country of their origin.

Online Essay Help Amazonia Fiocruz Br

What Is Foreign Direct Investment Fdi Fdi Advantages And Disadvantages A Plus Topper

Advantages And Disadvantages Of Fdi To Home Country Educate

What Is Foreign Direct Investment Fdi Fdi Advantages And Disadvantages A Plus Topper

Comments

Post a Comment